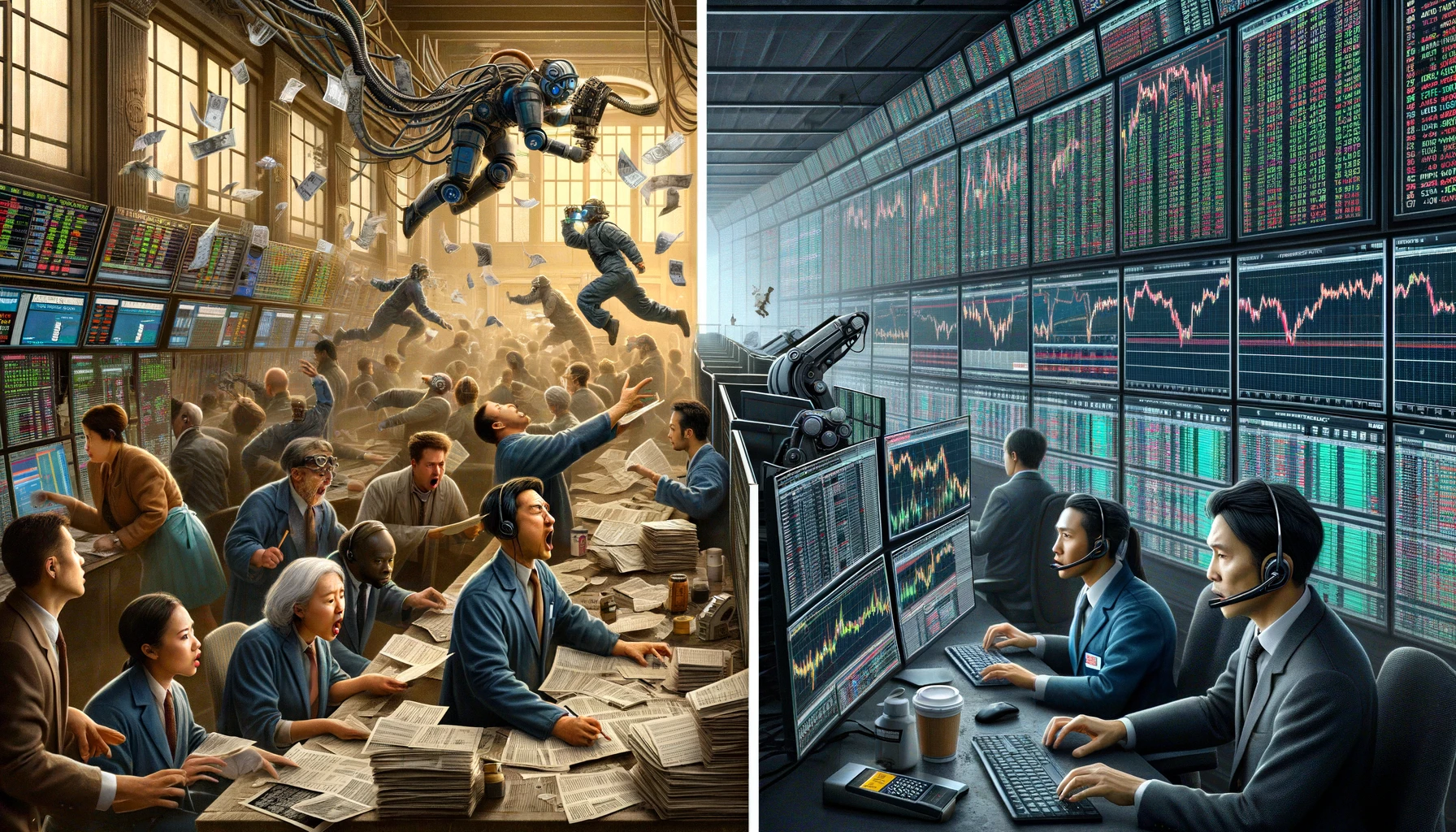

Trading, a cornerstone of the global economy, has experienced numerous transformations throughout history. From bustling trade floors filled with shouting brokers to the silent hum of servers executing millions of transactions in nanoseconds, the landscape of trading has been reshaped by both human ingenuity and technological advancements.

In today’s trading world, two dominant methods stand out: Traditional and Algorithmic. Traditional trading, rooted in human decision-making, has been the bedrock of commerce for centuries. It encapsulates the essence of human intuition, judgment, and the ability to read market sentiments, often driven by face-to-face interactions and manual processes. On the other hand, algorithmic trading represents the modern era’s zenith, where complex algorithms dictate buying and selling decisions, achieving speeds and precision unattainable by human hands.

But as traders and investors navigate the vast ocean of financial markets, a pressing question arises: Which trading method is superior? Or more pertinently, which is the right fit for an individual’s unique goals, risk tolerance, and trading style?

This article embarks on an enlightening journey to dissect both trading methodologies. By delving into their advantages, drawbacks, and core characteristics, we aim to provide readers with a comprehensive understanding, empowering them to make informed decisions in their trading endeavors.

I. Traditional Trading: An Overview:

Traditional trading, often referred to as discretionary trading, has been the backbone of the financial markets for centuries. At its core, it involves human decision-making, relying on expertise, intuition, and judgment to execute trades.

- Historical Roots The origins of traditional trading can be traced back to ancient civilizations, where commodities and goods were exchanged in bustling marketplaces. With the establishment of stock exchanges in major cities worldwide, traditional trading found its most iconic representation in the lively, shout-filled trading floors. Brokers, with phones in one hand and hand signals flying, personified the human touch in this trade form.

- Fundamental and Technical Analysis Traditional traders use a mix of fundamental and technical analysis to inform their decisions. Fundamental analysis delves into a company’s financial health, looking at metrics like earnings, balance sheets, and broader economic indicators. Technical analysis, on the other hand, focuses on price movements and trading volumes, seeking patterns that might predict future activity.

- The Human Element What distinguishes traditional trading is the emphasis on the human element. Traders base their decisions not only on data but also on their personal experiences, perceptions of market sentiment, and sometimes even gut feelings. Networking, building relationships, and face-to-face interactions often play a crucial role, especially in institutional trading.

- Challenges and Evolution While traditional trading offers the advantage of human judgment, it also comes with its set of challenges. Emotions, biases, and the limitations of manual execution can sometimes lead to less optimal decisions. With the advent of technology, many traditional traders have started using tools to assist them, blending the lines between traditional and algorithmic approaches.

II. Pros of Traditional Trading:

Traditional trading, anchored in human expertise and intuition, has stood the test of time for several reasons. Let’s delve into the primary advantages of this age-old method:

- Human Intuition and Judgment:

- In-depth Understanding: Human traders often possess a deep understanding of market dynamics, forged through years of experience. This depth allows them to interpret nuanced signals that algorithms might miss.

- Contextual Analysis: Humans have the unique ability to consider a broad array of factors, from geopolitical events to subtle shifts in market sentiment, enabling a holistic decision-making process.

2. Flexibility in Decision-Making:

- Adaptive Strategy: Unlike rigid algorithms, traditional traders can quickly adapt their strategies in real-time based on unfolding events or sudden market shifts.

- Tactical Withdrawals: In uncertain market situations, human traders can opt to step back, observe, and strategize, rather than feeling compelled to trade.

3. Personal Relationships and Networking Advantages:

- Trust-building: Personal relationships built over time often foster trust, crucial in trading partnerships.

- Inside Scoop: Networking can sometimes provide traders with insights or information that isn’t readily available to the public, giving them an edge.

4. Ability to Evaluate Market Sentiment in Real-Time:

- Emotional Pulse: Traditional traders can gauge the “mood” of the market, identifying fear, greed, or optimism, which can be pivotal in making informed decisions.

- Interpreting News: Humans can instantly comprehend the implications of breaking news, whereas algorithms might require updates or recalibrations to understand nuanced developments.

5. Reducing Systemic Risks:

- Human Oversight: With humans at the helm, there’s a reduced risk of cascading errors or glitches that can sometimes plague algorithmic systems.

- Ethical Decisions: Human traders can choose to avoid certain trades or investments based on ethical or moral grounds, adding a layer of conscience to the trading process.

III. Cons of Traditional Trading:

While traditional trading brings with it the wisdom of human experience, it also comes with several challenges and limitations. Here are the primary drawbacks of this method:

- Emotional Influences:

- Bias and Subjectivity: Human traders are susceptible to cognitive biases, like confirmation bias or loss aversion, which can cloud judgment and lead to suboptimal decisions.

- Emotional Swings: Periods of market volatility can trigger emotions like fear or greed, potentially causing rash decisions or hesitation at critical moments.

2. Limited Processing Speed:

- Delayed Execution: Unlike automated systems, manual trade execution can be slower, potentially missing out on optimal entry or exit points.

- Information Overload: Humans can struggle to process vast amounts of data simultaneously, which can be overwhelming and lead to missed opportunities.

3. Restricted Operational Hours:

- Physical Limitations: Human traders need breaks, sleep, and cannot monitor the markets 24/7. This limitation can be especially challenging in global markets that operate round the clock.

- Missed Opportunities: Important market movements can occur outside of one’s trading hours, leading to potential missed trades or the need for hasty adjustments upon return.

4. Possibility of Human Errors:

- Mistakes in Order Entry: Simple manual errors, like misplacing a decimal or choosing the wrong asset, can have significant ramifications.

- Memory Gaps: Relying on memory for past trade decisions or historical data can sometimes lead to oversight or repetition of past mistakes.

5. Increased Costs:

- Higher Transaction Fees: Traditional trading, especially through brokers, can come with higher transaction fees compared to automated trading platforms.

- Resource Intensive: Keeping up with traditional trading might require more resources, from subscribing to news services to potentially hiring research analysts or advisors.

IV. Algorithmic Trading: An Overview:

Algorithmic trading, sometimes known as algo-trading or black-box trading, harnesses advanced mathematical models and computer algorithms to make high-speed trading decisions. Over the past few decades, it has risen to prominence, transforming global trading practices. Let’s explore its intricacies:

Origins and Evolution:

- Born from the intersection of financial market expertise and technological advancements, algorithmic trading initially served to automate routine order execution, reducing manual work and potential for errors.

- As computational power advanced, so did the complexity and capabilities of trading algorithms, moving beyond simple automation to sophisticated strategies based on vast datasets and intricate logic.

Core Components:

- Trading Algorithms: At its heart, algo-trading relies on algorithms: pre-defined, systematic sets of instructions for analyzing market data and executing trades based on specific criteria. These can range from basic moving average crossovers to complex neural networks and machine learning models.

- High-Frequency Trading (HFT): A subset of algorithmic trading, HFT involves executing thousands of orders at extremely high speeds, often within microseconds. It seeks to capitalize on minute price discrepancies and is responsible for a significant portion of daily trading volume in many markets.

- Automation and Infrastructure: Beyond the algorithms themselves, a robust technological infrastructure is essential. This includes high-speed internet connections, dedicated servers, and redundancy measures to ensure uninterrupted trading.

Driving Factors:

- Speed and Precision: Computers can process vast amounts of information faster than humans, allowing for near-instantaneous trade execution.

- Data Analysis: With the ability to analyze big data, algorithms can identify patterns and trends that might be invisible or overwhelming to human traders.

- Cost Efficiency: By automating trades, transaction costs can be reduced, especially when trading in large volumes.

The Modern Landscape:

- Today, algorithmic trading is no longer the sole domain of institutional traders or hedge funds. With the democratization of technology, even individual traders have access to platforms and tools that allow for algorithmic strategies, leveling the playing field.

- Regulatory bodies worldwide have taken note of the rise of algo-trading, implementing rules and measures to ensure market fairness and mitigate potential risks associated with automated trading.

V. Pros of Algorithmic Trading:

Algorithmic trading, underpinned by technological advancements, has revolutionized the trading arena. Here are the primary benefits of this method:

- Speed and Efficiency:

- Rapid Execution: Algorithms can process and execute trades in milliseconds, allowing traders to capitalize on fleeting market opportunities.

- Consistent Operation: Computers can operate 24/7, ensuring no missed opportunities in global markets that function around the clock.

2. Data Handling and Analysis:

- Big Data Processing: Algorithms can analyze vast amounts of data at lightning speeds, identifying trends, patterns, and anomalies that might be overlooked by humans.

- Multifaceted Analysis: From historical data to real-time feeds, algorithmic trading can simultaneously evaluate multiple data sources for informed decision-making.

3. Precision and Accuracy:

- Eliminating Human Error: Automated systems reduce the risk of manual errors in order placement or execution.

- Consistent Criteria: Trading decisions are based on pre-defined criteria, ensuring consistency and adherence to the intended strategy.

4. Cost-Effectiveness:

- Lower Transaction Costs: Automated trades, especially in high volumes, often enjoy reduced transaction fees.

- Efficient Resource Use: Algo-trading can minimize the need for human intervention, leading to potential savings in human resources and related costs.

5. Backtesting Capabilities:

- Strategy Validation: Before deploying a trading algorithm, traders can test its effectiveness on historical data to refine and optimize their approach.

- Risk Assessment: Backtesting allows traders to assess potential pitfalls or shortcomings in their strategies, providing a clearer picture of risk.

6. Emotionless Trading:

- Objective Decisions: Algorithms operate devoid of emotions, ensuring that trading decisions aren’t influenced by fear, greed, or biases.

- Disciplined Approach: With its systematic nature, algo-trading adheres strictly to the set strategy, even during volatile market conditions.

7. Diversification Potential:

- Multiple Strategies & Assets: Algo-trading platforms can simultaneously handle multiple trading strategies across various assets, aiding in portfolio diversification.

- Global Reach: With the right infrastructure, traders can access and operate in multiple global markets seamlessly.

The advantages of algorithmic trading highlight its modern appeal, especially in a world that increasingly values speed, precision, and data-driven decision-making. However, as with any method, it’s essential to understand its limitations and potential risks alongside these benefits.

VI. Cons of Algorithmic Trading:

Despite its many advantages, algorithmic trading is not without its challenges and potential drawbacks. Here are the primary cons associated with this method:

- Systemic Risks:

- Flash Crashes: Over-reliance on automated trading systems can lead to rapid market downturns, like the notable 2010 Flash Crash where the Dow Jones plummeted and recovered within minutes.

- Glitches and Bugs: A small coding error can result in significant financial losses or unintended market disruptions.

2. Over-Optimization:

- Curve Fitting: While algorithms can be precisely tailored to past data, this over-optimization can lead to poor real-world performance since past patterns don’t always predict future outcomes.

- Lack of Adaptability: Highly optimized algorithms might struggle in new or unexpected market conditions.

3. Barrier to Entry:

- Technical Complexity: Building, testing, and deploying trading algorithms requires specialized knowledge, which might be daunting for newcomers.

- Infrastructure Costs: The need for high-speed connections, powerful servers, and redundancy measures can be capital-intensive.

4. Lack of Intuition and Human Touch:

- Missed Nuances: Algorithms might overlook subtle market signals or the implications of world events that human traders can intuitively grasp.

- No Gut Feelings: Sometimes, traders rely on intuition, a culmination of years of experience, which algorithms can’t replicate.

5. Market Manipulation Concerns:

- Quote Stuffing: Some high-frequency trading strategies might flood the market with orders to confuse competitors, leading to concerns about market manipulation.

- Front Running: Algorithms might detect large orders from other participants and execute trades just before those, capitalizing on the ensuing price shift.

6. Regulatory and Ethical Concerns:

- Regulatory Scrutiny: As algorithmic trading grows in prominence, it faces increased regulatory oversight, which can impact strategies and operations.

- Ethical Dilemmas: The impersonal nature of algo-trading can sometimes lead to questions about its ethical implications, especially concerning market fairness.

7. Dependency and Complacency:

- Over-reliance: Traders might become overly reliant on automated systems, leading to complacency in monitoring and oversight.

- Skill Erosion: Over time, traders might lose touch with manual trading skills, becoming overly dependent on algorithms even when human judgment is required.

While algorithmic trading offers numerous benefits, especially in the modern age, understanding its potential pitfalls is crucial. Balancing its pros and cons can help traders navigate the complex world of automated trading more effectively.

VI. Cons of Algorithmic Trading:

Despite its many advantages, algorithmic trading is not without its challenges and potential drawbacks. Here are the primary cons associated with this method:

- Systemic Risks:

- Flash Crashes: Over-reliance on automated trading systems can lead to rapid market downturns, like the notable 2010 Flash Crash where the Dow Jones plummeted and recovered within minutes.

- Glitches and Bugs: A small coding error can result in significant financial losses or unintended market disruptions.

2. Over-Optimization:

- Curve Fitting: While algorithms can be precisely tailored to past data, this over-optimization can lead to poor real-world performance since past patterns don’t always predict future outcomes.

- Lack of Adaptability: Highly optimized algorithms might struggle in new or unexpected market conditions.

3. Barrier to Entry:

- Technical Complexity: Building, testing, and deploying trading algorithms requires specialized knowledge, which might be daunting for newcomers.

- Infrastructure Costs: The need for high-speed connections, powerful servers, and redundancy measures can be capital-intensive.

4. Lack of Intuition and Human Touch:

- Missed Nuances: Algorithms might overlook subtle market signals or the implications of world events that human traders can intuitively grasp.

- No Gut Feelings: Sometimes, traders rely on intuition, a culmination of years of experience, which algorithms can’t replicate.

5. Market Manipulation Concerns:

- Quote Stuffing: Some high-frequency trading strategies might flood the market with orders to confuse competitors, leading to concerns about market manipulation.

- Front Running: Algorithms might detect large orders from other participants and execute trades just before those, capitalizing on the ensuing price shift.

6. Regulatory and Ethical Concerns:

- Regulatory Scrutiny: As algorithmic trading grows in prominence, it faces increased regulatory oversight, which can impact strategies and operations.

- Ethical Dilemmas: The impersonal nature of algo-trading can sometimes lead to questions about its ethical implications, especially concerning market fairness.

7. Dependency and Complacency:

- Over-reliance: Traders might become overly reliant on automated systems, leading to complacency in monitoring and oversight.

- Skill Erosion: Over time, traders might lose touch with manual trading skills, becoming overly dependent on algorithms even when human judgment is required.

While algorithmic trading offers numerous benefits, especially in the modern age, understanding its potential pitfalls is crucial. Balancing its pros and cons can help traders navigate the complex world of automated trading more effectively.

VIII. Key Considerations in Choosing a Trading Approach:

The choice between traditional and algorithmic trading is not a one-size-fits-all decision. It hinges on multiple factors, each vital to understand for making an informed decision. Here are some key considerations:

- Risk Tolerance:

- Emotion vs. Automation: Traditional trading can be influenced by emotions, leading to potential risks but also allowing for intuition-based decisions. Algorithmic trading, on the other hand, sticks strictly to pre-defined rules, reducing emotional risks but also lacking human intuition.

- Operational Risks: While algorithmic trading can result in systemic risks like flash crashes, traditional trading has the risk of human error.

2. Capital and Infrastructure:

- Initial Investment: Algorithmic trading often requires significant initial capital for infrastructure, software, and data. Traditional trading might have lower start-up costs but may involve higher transaction fees over time.

- Maintenance Costs: Algo-trading platforms may have ongoing costs for software updates, server maintenance, and data subscriptions.

3. Skillset and Knowledge Base:

- Technical Proficiency: Algorithmic trading requires a grasp of programming, data analysis, and system maintenance. Traditional trading leans more towards market knowledge, intuition, and relationship-building.

- Continuous Learning: Both fields demand ongoing education—staying updated with market trends for traditional traders and keeping abreast of technological advancements for algorithmic traders.

4. Time Commitment:

- Active vs. Passive: Traditional trading might require constant market monitoring, especially for day traders. Algorithmic trading, once set up, can operate passively, although algorithms do need periodic reviewing and tweaking.

- Market Hours: For traders interested in international markets, algorithmic systems can trade 24/7, while traditional traders might be limited by their operational hours.

5. Goals and Strategies:

- Short vs. Long Term: High-frequency algorithmic strategies aim for quick profits from minute price changes, while some traditional approaches might focus on longer-term investments based on fundamentals.

- Diversification: Algorithmic platforms can manage multiple strategies across various assets simultaneously, aiding diversification. Traditional traders might need to manually manage and diversify their portfolios.

6. Ethical and Personal Preferences:

- Market Impact: Some traders may have reservations about high-frequency trading’s impact on market stability or its fairness.

- Human Touch: Traders who value personal relationships, trust-building, and a hands-on approach might lean towards traditional trading.

7. Regulatory Environment:

- Regulatory Changes: Algorithmic trading is seeing increased regulatory scrutiny worldwide, which can impact strategies and profitability.

- Compliance: Both traditional and algorithmic traders must stay updated with regulatory changes, but algo-traders might also need to ensure their systems are compliant.

In conclusion, the choice between traditional and algorithmic trading is multifaceted. It’s vital for traders to introspect, understand their priorities, and evaluate both approaches’ pros and cons in light of these considerations to make the best decision for their unique situation.

Conclusion: What's Best for You? :

In the rapidly evolving landscape of trading, both traditional and algorithmic approaches offer unique advantages and challenges. The optimal choice isn’t universally applicable but is rather a deeply personal decision based on individual preferences, goals, and circumstances.

For some, the allure of traditional trading lies in its human touch. It allows for intuition, relationship-building, and a hands-on approach, blending art with the science of market dynamics. Those who value face-to-face interactions, trust the power of their instincts, and enjoy dissecting market news might find solace in this method.

Conversely, the tech-savvy individuals who are drawn to precision, automation, and data-driven decision-making might lean towards algorithmic trading. It’s ideal for those who prefer strategies set in code, value speed and efficiency, and are comfortable navigating the intricate world of algorithms.

However, the binary choice of one over the other isn’t necessary. A hybrid approach, combining the best of both worlds, might be the golden mean for many. This strategy can harness the computational prowess of algorithms while allowing for human discretion when unpredicted market anomalies arise.

Ultimately, the best trading approach is a function of introspection. It requires an honest assessment of one’s risk tolerance, financial goals, available capital, skillset, and, importantly, what one finds personally fulfilling. In the trading realm, self-awareness isn’t just a virtue—it’s the compass guiding every decision.