Commodity trading stands as a vital pillar in the global financial landscape, presenting a dynamic and intricate market for investors and traders.

This arena encompasses the buying and selling of essential raw materials, ranging from energy sources like oil to precious metals such as gold, and agricultural products including coffee and wheat.

These commodities play a crucial role in shaping global economies and everyday life. Our comprehensive guide delves into the complexities of this market, highlighting key strategies, market influences, and the impact of technological advancements and global events.

Understanding Commodities

Commodities are fundamental goods integral to global trade, categorized mainly into agricultural, energy, and metals. Agricultural commodities, like wheat and coffee, are vital for food supply but susceptible to environmental and geopolitical changes.

Energy commodities, including crude oil and natural gas, are essential for powering industries and transportation, with prices sensitive to international politics and technological shifts. Metals, divided into precious (like gold) and base metals (such as copper), have diverse uses from investment to manufacturing.

Comprehending these commodities is essential as they influence global economies, impacting inflation and currency values. Traded on various exchanges, they’re not just raw materials but also key financial assets, offering opportunities and risks for investors, shaping policy decisions, and reflecting the health of economies worldwide.

How Commodity Markets Work

Step into the vibrant world of commodity markets, a thrilling arena where everyday items like wheat, oil, and gold play starring roles in a global economic theatre. Here, these raw materials are more than just goods; they’re the lifeblood of trade and industry, constantly bought and sold like actors on a stage.

At the heart of this action are commodity exchanges bustling hubs where traders and investors gather, not just to exchange goods, but to predict and plan for the future. It’s a world of spot markets, where commodities change hands immediately, and futures markets, where traders bet on what a barrel of oil or a bushel of wheat will be worth months down the line.

Brokers and traders are the maestros of this market, deftly conducting deals and navigating intricate price movements. Their decisions can send ripples across the globe, affecting everything from the price at the pump to the cost of your morning coffee.

This market is a dynamic mix of tradition and innovation, where age-old trading principles meet cutting-edge technology. It’s a place where every decision, every trade, shapes our world in real-time. Welcome to the fascinating, ever-changing world of commodity markets, where global economics plays out in the most practical, everyday commodities.

Strategies for Commodity Trading

In the ever-changing world of commodity trading, several key strategies help traders navigate the market effectively:

- Fundamental Analysis:

- Fundamental analysis involves assessing the basic supply and demand factors that influence commodity prices. Traders analyze data like crop yields, weather patterns, political climate, and economic reports to predict market movements. Understanding these elements is crucial for making informed trading decisions.

- Technical Analysis:

- Traders use historical price data and chart patterns to forecast future market trends. This method includes examining moving averages, trend lines, and other statistical indicators. It’s a strategy favored for its ability to identify potential entry and exit points in the market.

- Diversification:

- A vital risk management strategy, diversification involves spreading investments across various commodities or other asset classes. This approach helps in reducing the risk of significant losses due to adverse price movements in any single commodity.

- Risk Management:

- Effective risk management is essential. Traders set stop-loss orders to limit potential losses and manage the size of their positions relative to their total investment capital. This disciplined approach ensures that traders do not overexpose themselves to market volatility.

- Staying Informed:

- Keeping abreast of global events and market news is critical. Changes in government policies, international conflicts, or economic shifts can drastically affect commodity prices. Staying informed helps traders anticipate market movements and adjust their strategies accordingly.

Implementing these strategies requires a blend of research, analytical skills, and a steady approach to handling market volatility. By employing these methods, traders can enhance their chances of success in the complex world of commodity trading.

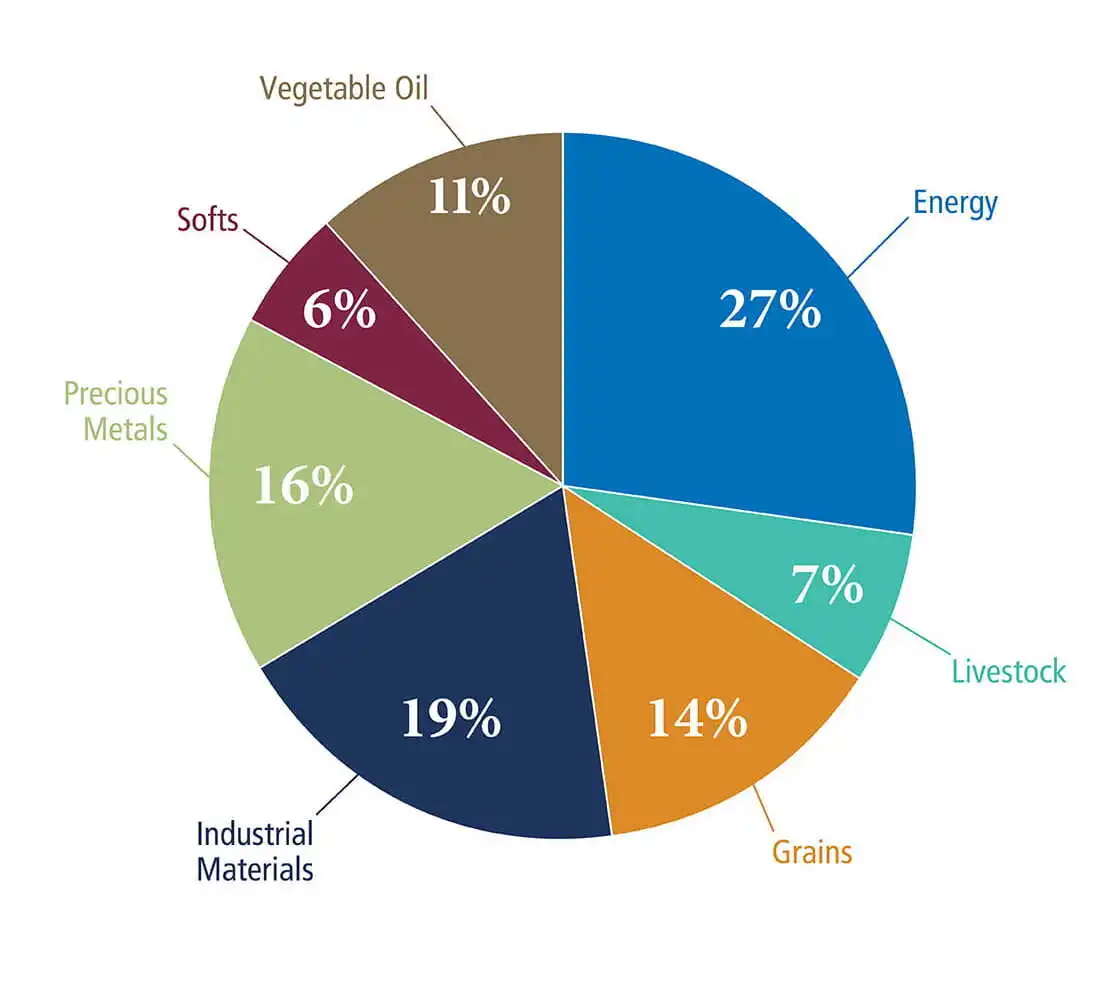

Commodity Market Share Breakdown

The above pie chart offers a snapshot of the various commodities that make up the trading market, highlighting their respective shares:

- Energy (27%): Dominating the market, energy commodities like crude oil, natural gas, and coal are foundational to the global energy supply. This segment’s prominence underscores its critical role in driving industries, transportation, and heating, reflecting the world’s reliance on energy resources.

- Grains (19%): Serving as the cornerstone of the global food supply, grains such as wheat, corn, and rice are pivotal. This substantial market share indicates not only the necessity of grains for sustenance but also their role as key players in global trade, affected by climate conditions and agricultural policies.

- Industrial Materials (16%): This category includes essential raw materials for construction and manufacturing, like steel, copper, and aluminum. The significant share of industrial materials demonstrates their importance in infrastructure development and the production of goods, from electronics to automobiles.

- Precious Metals (14%): Gold, silver, and platinum, known for their economic and cultural value, serve as investment vehicles and industrial components. Their market share reflects ongoing demand for wealth preservation, industrial use, and jewelry.

- Livestock (7%): This segment covers live animals and products like meat, dairy, and wool. The 7% share of livestock commodities highlights their role in meeting the global demand for food and clothing.

- Vegetable Oil (11%): Comprising oils from crops like soybean, palm, and canola, this sector is vital for cooking, processed foods, and increasingly for biofuel. The market share represents the growing demand for vegetable oils in diverse industries.

- Softs (6%): Soft commodities include agricultural products that are grown rather than mined, such as coffee, sugar, and cotton. With a 6% share, these commodities are integral to a variety of sectors, from food and beverage to textiles, reflecting varied consumer demands and lifestyle needs.

Commodity Trading Digitalization

The digital transformation of commodity trading is an ongoing revolution, characterized by the integration of cutting-edge technologies that are making markets more accessible and transparent. Blockchain technology is at the forefront, offering a decentralized ledger that enhances the security and speed of transactions.

Artificial intelligence and machine learning are analyzing vast amounts of data for better predictive trading models, while automated trading systems execute trades at speeds and accuracies unattainable by humans.

These advancements promise greater efficiency and reduced costs, opening the door to new players and reshaping the traditional trading landscape. As these technologies mature, they are set to redefine commodity trading, making it a more level playing field for all market participants.

Commodities vs Stocks: Key Differences

| Comparative Factor | Commodity Trading | Stock Trading |

|---|---|---|

| Nature of Assets | Physical goods such as agricultural products, metals, and energy. | Shares representing ownership in a company. |

| Volatility | Often high due to external factors like weather changes and political instability. | Generally moderate, though can vary based on news and market sentiment. |

| Liquidity | Major commodities are highly liquid, while others may have lower liquidity. | Usually high, especially for stocks of well-established companies. |

| Investment Approach | Short-term trading is common due to quick price shifts. | Includes both short-term trading and long-term investments. |

| Key Analysis Techniques | Heavily reliant on fundamental analysis related to global events and supply-chain factors. | Balances between fundamental analysis and technical analysis. |

| Leverage and Margins | High leverage is common, increasing both potential profit and risk. | Leverage varies; typically lower compared to commodity trading. |

| Economic Impact Sensitivity | Highly sensitive to immediate global events and economic changes. | More influenced by long-term economic trends |

| Regulatory Environment | Governed by commodity-specific regulations and international trade agreements. | Subject to securities regulations and stock exchange rules. |

Future Outlook

The horizon of commodity trading is being reshaped by innovation and global shifts. Technological advancements like blockchain and artificial intelligence are poised to streamline trading processes, bolster transparency, and refine predictive analytics. A heightened focus on sustainability is also driving the market towards eco-friendly commodities and renewable energies, in response to environmental and social governance trends. Geopolitical developments, especially in burgeoning economies, are anticipated to redefine supply and demand curves, influencing commodity prices and trade flows. Furthermore, traders are expected to adopt more nuanced diversification strategies, expanding into emerging commodities and derivatives as buffers against market volatility. Collectively, these factors herald a transformed commodity trading landscape that is technologically advanced, environmentally conscious, and globally interconnected.

In the end, it’s clear that this market is a vital component of the global economy. The insights provided offer a roadmap for understanding and participating in commodity trading, from grasping fundamental concepts to exploring advanced strategies. As trends evolve and new technologies emerge, staying informed and adaptable will be key for success. Whether you’re a seasoned trader or a newcomer, the world of commodities presents a landscape ripe with opportunities for growth and investment.

FAQS

The best strategy for commodity trading often involves a combination of fundamental and technical analysis. Fundamental analysis assesses supply, demand, and external factors affecting commodities, like geopolitical events or weather patterns. Technical analysis focuses on price movements and chart patterns to predict future trends. Diversifying investments across different commodities can also mitigate risks. It’s crucial to stay informed and adaptable, as commodity markets can be volatile and influenced by global events.

The most important commodity in world trade is crude oil. Its pivotal role stems from being the primary source of energy globally, powering industries, transportation, and heating. Oil’s price and availability significantly influence economic growth and stability, impacting nearly every sector. As a heavily traded commodity, oil prices fluctuate based on geopolitical events, supply and demand dynamics, and technological advancements in energy sectors, making it a critical focus in global trade.

Commodity trading can be highly profitable, but it’s also associated with significant risk. Success depends on the trader’s ability to understand and predict market trends, influenced by factors like geopolitical events, economic indicators, and supply-demand dynamics. While experienced traders can achieve substantial gains, especially in volatile markets, it requires in-depth knowledge, strategic planning, and risk management. Beginners should approach with caution, as commodity markets are complex and can lead to substantial losses.

Gold is often considered the safest commodity for trading due to its stability and role as a “safe haven” during economic uncertainties. Unlike other commodities, gold’s value doesn’t heavily depend on industrial demand but is driven by its status as a store of value and hedge against inflation and currency devaluation. Its historical resilience in times of financial crises makes it a preferred choice for risk-averse investors in the commodity market.

Commodity trading is indeed a risk-laden venture. It’s subject to high volatility due to factors like geopolitical events, environmental changes, and fluctuations in supply and demand. Prices can rapidly shift, leading to significant gains or losses. This market requires a deep understanding of global economic trends and sector-specific knowledge. While it offers opportunities for high returns, it also poses substantial risk, making it more suitable for experienced traders or those willing to undertake careful risk management.